Different generations spend their money in very different ways. Baby boomers often invested in things that symbolized stability and success, while Gen Z is more cautious about where their money goes. Rising costs, shifting values, and a preference for experiences over “stuff” makes these classic boomer purchases unappealing to this generation.

Cable TV

Boomers stuck with cable for decades, but Gen Z is cutting the cord fast. With so many streaming services available, young people see little point in paying huge monthly bills for channels they don’t watch. On-demand entertainment feels cheaper, easier, and more personalized.

💸 Take Back Control of Your Finances in 2025 💸

Get Instant Access to our free mini course

5 DAYS TO A BETTER BUDGET

Fancy China Sets

Fine china was once a wedding registry staple, but younger generations aren’t interested. Gen Z prefers everyday dishes that are durable and affordable. Spending hundreds on delicate plates that only come out once a year just doesn’t fit their lifestyle.

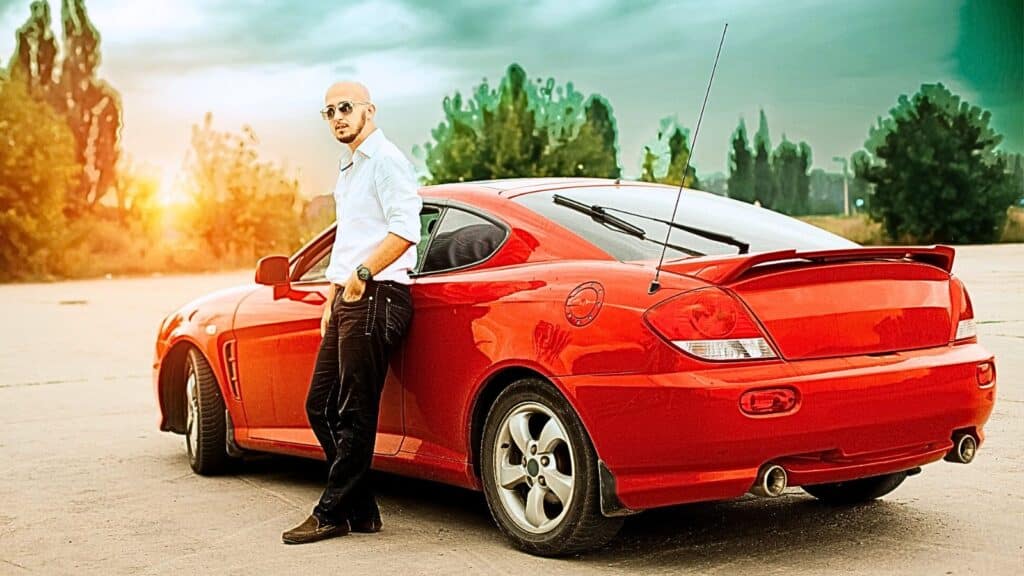

Expensive Cars

For many boomers, buying a shiny new car was a status symbol. Gen Z leans toward used cars or public transportation instead. High auto loan costs and insurance rates make flashy vehicles feel more like a burden than a milestone.

Big Diamond Rings

Boomers valued large diamonds as a sign of love and success, but Gen Z is pushing back. Many are choosing lab-grown diamonds or alternative stones to save money. For them, meaning matters more than price.

Golf Club Memberships

Country club memberships used to be a goal for many boomers. Gen Z, however, sees them as overpriced and outdated. They’re more likely to spend money on fitness classes, outdoor adventures, or affordable group activities instead of annual fees.

McMansions

Large suburban homes once represented success, but Gen Z isn’t buying in. With rising housing costs and interest rates, many prefer smaller homes, condos, or renting. The idea of maintaining a giant house feels impractical and unaffordable.

Cable Landline Phones

Boomers were loyal to their home landlines, but Gen Z has no interest. Smartphones cover every communication need, and landline service is seen as an unnecessary extra bill. Paying for a second phone line feels outdated.

Magazine Subscriptions

Glossy magazines once filled coffee tables, but Gen Z is not signing up. With free news and endless digital content online, paying for a print subscription feels wasteful. They still consume media — just not in the traditional boomer way.

Designer Handbags

Luxury handbags were once a status marker, but Gen Z isn’t buying into it. Many prefer sustainable or secondhand options instead of dropping thousands on a purse. Even when they splurge, they’re often more focused on tech than fashion.

Formal Dining Rooms

Boomers built houses with separate dining rooms, but younger people see them as wasted space. Open layouts and multi-use spaces are more appealing to Gen Z homeowners. A dedicated room for a few holiday meals doesn’t justify the extra cost.

Cable News Packages

Boomers rely on cable news, but Gen Z gets their headlines from social media, podcasts, and free online outlets. Paying for news bundles doesn’t make sense when they can access updates instantly on their phones.

Changing Priorities

What boomers once saw as “must-haves,” Gen Z sees as optional — or not worth the money at all. Rising costs play a role, but so does a shift toward practicality, flexibility, and experiences over material possessions.

10 Ways Lifestyle Inflation is Quietly Wrecking Your Budget

Lifestyle inflation, also known as lifestyle creep, happens when your spending rises alongside your income. It’s sneaky. You earn more, so you begin to spend more on things you once considered luxuries. Over time, this can leave you stuck in a financial rut, unable to save or invest for the future. While enjoying the fruits of your hard work is fine, unchecked lifestyle inflation can quietly undermine your financial goals. Here’s how it might be affecting your budget. 10 Ways Lifestyle Inflation Is Quietly Wrecking Your Budget