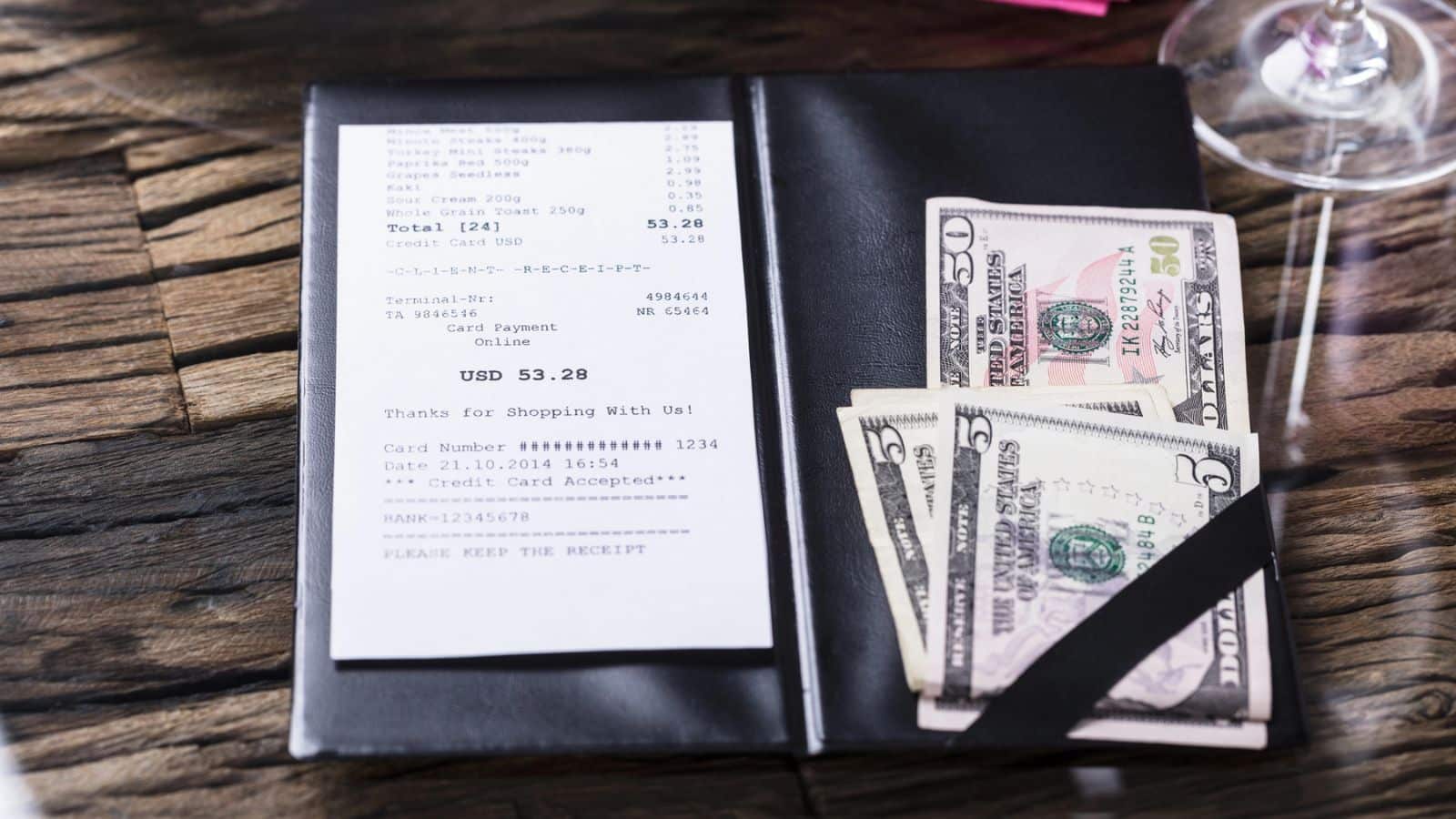

Tipping used to be simple—servers, barbers, the pizza delivery guy. Now, it feels like every checkout screen is asking for more. Coffee shops, food trucks, even self-checkouts are adding tip prompts, and people are starting to feel worn out. The constant pressure is fueling what many now call “tipping fatigue.”

Tip Screens Are Popping Up Everywhere

It’s not just restaurants anymore. Tip screens are now at fast food counters, retail stores, and even self-serve kiosks. When you’re prompted to tip for something that didn’t involve personal service, it feels forced—and people are starting to push back.

💸 Take Back Control of Your Finances in 2025 💸

Get Instant Access to our free mini course

5 DAYS TO A BETTER BUDGET

Suggested Tip Amounts Are Increasing

Not long ago, 15% was the standard. Now, tip prompts often start at 20% or even 25%. These higher default suggestions create pressure, making customers feel guilty for selecting a lower amount—even when it doesn’t feel justified.

Service Fees and Tipping Overlap

Many businesses have added “service fees” or “living wage” charges to bills—but still ask for a tip. Customers feel like they’re being double-charged for the same thing, and it’s creating resentment. The lack of clarity on where the money goes makes it worse.

Wages Shouldn’t Fall on the Customer

A lot of consumers feel tipping has shifted from a thank-you to an obligation. Instead of employers paying fair wages, the responsibility is falling on customers through constant tip prompts. This shift feels unfair, especially when prices are already high.

The Emotional Guilt Trip

Tip jars used to be anonymous. Now, digital tip prompts happen face-to-face, with the employee watching. That adds social pressure, making people feel guilty for declining—even when tipping doesn’t make sense in that context. The emotional exhaustion is real.

Economic Strain on Consumers

With rising costs everywhere—groceries, rent, gas—many people are barely making ends meet. Being asked to tip on every small purchase adds to the financial strain. It’s not about being cheap; it’s about reaching a tipping point where small extras are too much.

Lack of Transparency on Where Tips Go

Consumers are becoming more aware that tips don’t always go directly to employees. When businesses pool tips or use them to offset wages, it feels deceptive. If customers aren’t sure who’s benefiting, they’re less willing to keep tipping out of habit.

The Over-Saturation Effect

When tipping feels like it’s expected at every turn, it loses its meaning. Constant exposure to tip prompts has numbed people, turning generosity into frustration. What was once a personal gesture of appreciation now feels like a forced routine.

Pushback Against Tipping Culture Is Growing

More people are openly discussing tipping fatigue on social media, sharing experiences and frustrations. This collective pushback is making it more acceptable to decline tipping prompts in inappropriate situations. Consumers are starting to draw clearer boundaries.

10 Bad Spending Habits Keeping You Stuck in the Paycheck-to-Paycheck Cycle

Living paycheck to paycheck can feel like a never-ending loop. You work hard, but there’s never quite enough left at the end of the month. If you’ve ever wondered why it’s so hard to get ahead, your spending habits may be one of the biggest culprits. Here are 10 habits that may be draining your wallet and keeping you in financial frustration. 10 Bad Spending Habits Keeping You Stuck in the Paycheck-to-Paycheck Cycle