Ever glance at your bank statement and spot a charge you barely remember? Plenty of people pay for subscriptions that have long been forgotten. These quiet fees sneak onto your bill month after month and cut into your budget without much notice. Here are ten subscriptions that could still be costing you money—even if you haven’t touched them in ages.

Streaming Services You Barely Use

With so many streaming platforms, it’s easy to sign up for a show or movie, then let that subscription roll. If you only watch occasionally, that monthly fee still stacks up. Take a minute to check what you’re actually watching and cancel anything that isn’t getting use.

💸 Take Back Control of Your Finances in 2025 💸

Get Instant Access to our free mini course

5 DAYS TO A BETTER BUDGET

Cloud Storage Plans

Maybe you upgraded for extra space, then switched to a different service or stopped backing up your files. Old cloud storage plans linger quietly on your account. Review your storage needs and cut loose any extras you’re not using.

Magazine or News App Subscriptions

A cheap deal on digital magazines or news may have tempted you months ago, but is it still worth it? Small fees for content you don’t read anymore can pile up over time. Scan your subscriptions for old news and magazine services.

Gym Memberships

Many people sign up for the gym, go for a while, then slow down or switch routines, but the monthly fee keeps coming. If it’s been months since your last visit, double-check if you’re still being billed.

App Upgrades and Game Passes

Those little upgrades in games and apps seem harmless, but they stay on auto-renew. If you’ve moved on to other apps or no longer need the extras, cancel before another cycle hits your account.

Meal Kit Deliveries

Meal kits are convenient for busy weeks, but easy to forget when your routine changes. Even after you stop ordering, some companies keep your subscription active. Make sure you’ve paused or canceled all delivery plans you don’t use.

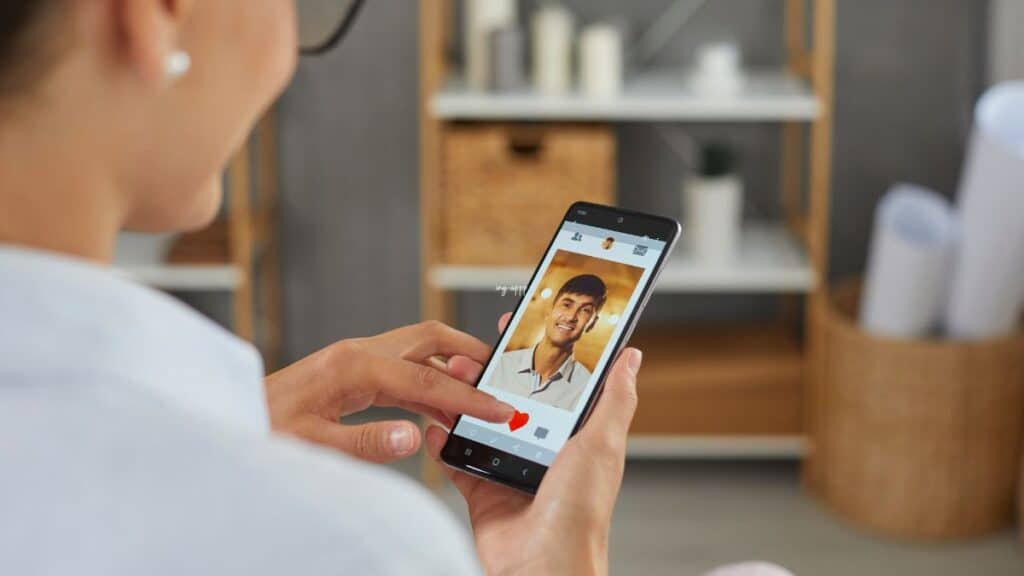

Dating App Subscriptions

Premium dating apps add extra features—for a price. If you’re in a relationship or have stopped using the app, see if you’re still paying for premium access you don’t need.

Software Subscriptions

Maybe you bought editing or design software for a project, then forgot about it. These tools often charge monthly or yearly, quietly taking money even after you’re done. List out all your paid software and nix the ones you no longer need.

Music Streaming Services

That monthly music fee continues, even when you rarely listen. If you’ve switched platforms or just don’t use it much, check your accounts for unwanted charges.

Online Learning Platforms

Sign up for a course, finish or lose interest, and the monthly or annual charges keep coming. Look over your learning subscriptions and cancel any that no longer fit your plans.

Keeping Tabs on Subscriptions

Forgotten subscriptions have a way of sneaking up on your budget. Taking a few minutes every couple of months to review what you’re paying for helps stop waste and frees up money for things you truly use or enjoy. Being a little more mindful can make a real difference in your monthly budget.

10 Sneaky Expenses Keeping You From Reaching Your Financial Goals

Managing money isn’t easy, and hidden costs can easily derail progress. It’s not just big-ticket purchases that hurt your savings; small, sneaky expenses often fly under the radar. Identifying and addressing these expenditures can dramatically improve your financial health. Here are ten common culprits that could be blocking your financial goals. 10 Sneaky Expenses Keeping You From Reaching Your Financial Goals