Managing debt is tough, but having a solid payoff plan can make all the difference. If your current strategy isn’t getting you the results you hoped for, it’s probably time to reassess. Here are eleven signs that your debt plan needs a major overhaul and what you can do about it.

You’re Not Seeing Progress

If you feel like you’re paying on your debt but the balance doesn’t seem to move, your plan isn’t working. It’s frustrating when you’re consistently making payments and still not seeing any significant change. This could be a sign that you’re not paying down the principal fast enough or that your interest rates are too high. Consider focusing on high-interest debts first or consolidating them for a better rate.

💸 Take Back Control of Your Finances in 2025 💸

Get Instant Access to our free mini course

5 DAYS TO A BETTER BUDGET

You’re Struggling to Keep Up With Payments

If you’re constantly juggling payments or falling behind, it’s time to adjust your strategy. A debt plan should work with your income, not against it. If your payments feel unmanageable, it may be time to reduce your expenses, increase your income, or explore restructuring options like debt consolidation or refinancing.

You’re Paying Just the Minimum

Paying only the minimum amount due will keep you in debt longer and lead to paying much more in interest over time. If you’re stuck in the minimum payment cycle, you’re not making real progress. A good debt repayment plan should aim to pay off the principal faster to reduce the total amount you owe. Aim to pay more than the minimum whenever possible.

You’re Not Tracking Your Spending

A solid debt plan requires a good grasp of your overall financial situation. If you’re not tracking your spending, it’s easy to overspend and not allocate enough toward your debt. Start tracking where your money goes each month to ensure you’re staying on budget and prioritizing debt repayment.

You’re Borrowing to Pay Off Debt

If you’re borrowing from one card or loan to pay off another, it’s a major red flag. This cycle of borrowing and transferring balances only delays the inevitable and increases your debt load. It may be time to rethink your approach, cut back on borrowing, and focus on paying off your balances with real income, not credit.

You’re Not Addressing the Root Cause of Your Debt

It’s one thing to have a plan to pay off debt, but it’s another to address why you got there in the first place. If you’re still living beyond your means or relying on credit for everyday expenses, you’re likely going to end up back in debt. Focus on changing your spending habits and creating a sustainable financial lifestyle to ensure you’re not just putting a temporary band-aid on a bigger issue.

You’re Using Debt to Fund Your Lifestyle

Using credit cards or loans to fund things like vacations, clothing, or eating out can make your debt problems worse. If your debt plan doesn’t address this kind of spending, you’re just increasing the problem. Cut back on discretionary spending until your debt is under control, and make sure your lifestyle aligns with your current financial situation.

Your Interest Rates Are Too High

If your credit cards or loans have high interest rates, it can feel like you’re never making progress. High-interest rates mean more of your monthly payments go toward interest, leaving you little to pay down the principal. If possible, look into transferring balances to a lower-interest card or consolidating your debt for a better rate. The goal is to minimize the impact of interest on your total debt.

You’re Not Adjusting Your Plan as Life Changes

Life changes, and so should your debt plan. If you’ve recently had a change in income, moved, or started a family, you may need to reassess your debt strategy. A rigid plan that doesn’t allow for flexibility can set you up for failure. Keep adjusting your plan as necessary to account for changes in your financial situation.

You’re Avoiding Professional Help

If you’ve been trying to tackle your debt on your own and it’s just not working, it might be time to seek help. Debt counseling services or a financial advisor can offer valuable insights and help you create a plan that works for you. Don’t be afraid to ask for help—it could be the key to finally getting your debt under control.

Your Debt Is Only Growing

If your debt continues to grow despite your efforts to pay it off, it’s a clear sign your current plan isn’t effective. You may need to shift your focus, increase your payments, or cut back on unnecessary expenses. Debt should be shrinking, not growing—take a hard look at your strategy and find ways to make it work.

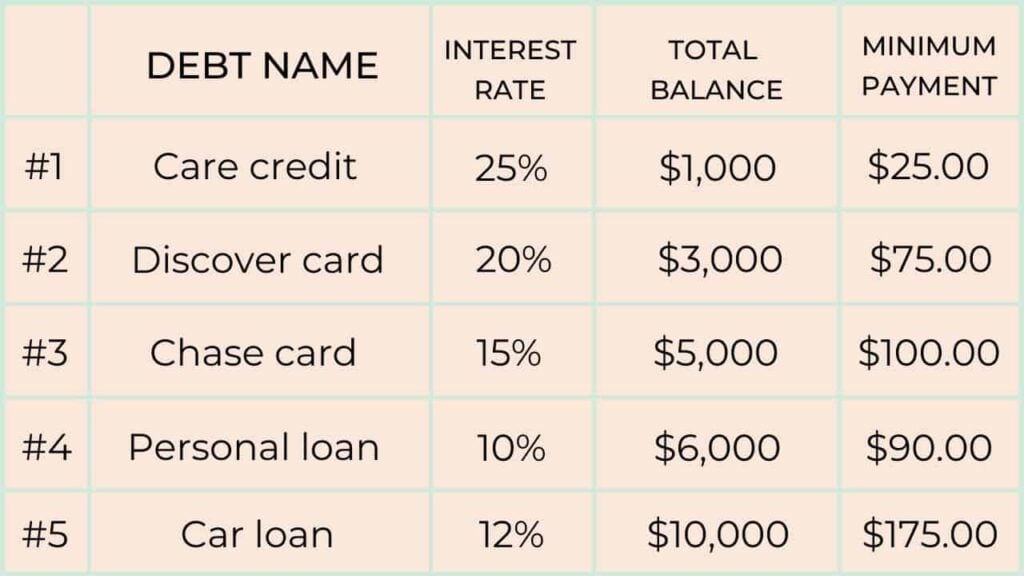

You’re Not Using a Debt Snowball or Debt Avalanche Method

If you’re not using one of the popular debt repayment methods like the debt snowball or debt avalanche, you may be missing out on an efficient way to pay down your debts. These methods prioritize your debts either by size (snowball) or by interest rate (avalanche), helping you focus your efforts and pay off your debt faster. If you haven’t tried one of these methods, it might be time to give it a shot.

You’re Not Celebrating Milestones

Paying off debt is a long-term process, and it can be tough to stay motivated without celebrating small wins. If you’re not acknowledging progress, you might feel like you’re not making any at all. Set milestones for yourself and reward your efforts, whether it’s paying off a smaller debt or reaching a savings goal.

A Better Debt Plan

If any of these signs are familiar to you, it’s time to rethink your debt plan. The right plan will help you make progress, reduce stress, and create financial stability. Take the time to assess your current approach, make necessary adjustments, and stay flexible as life changes. A little awareness now can lead to big changes down the road, helping you get out of debt faster and stay there for good.

Want simple tips to save more, stress less, and take control of your money delivered straight to your inbox? Subscribe to our free newsletter and check out these popular posts: How to Save Thousands on Your Grocery Budget and 5 Reasons Index Funds Are the Best Investment for New Investors. Follow Cents + Purpose on MSN for more helpful money tips!