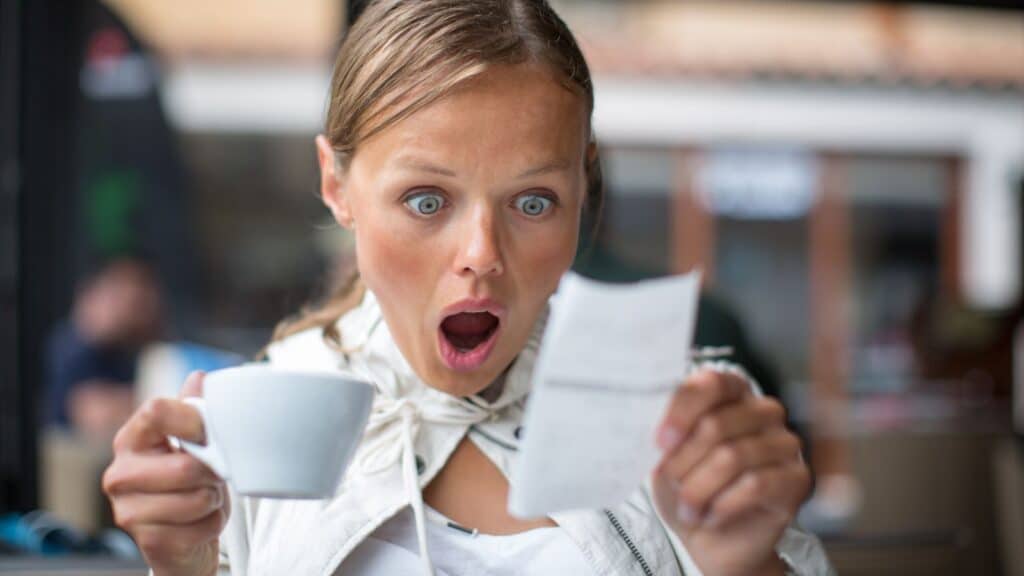

Many people can’t get through the day without coffee, but the habit isn’t cheap. Picking up a latte here and an extra shot there adds up fast. Before you notice, you’ve spent hundreds in a year on what feels like pocket change. Here are nine coffee habits that are costing you more than you think.

Buying Coffee on the Way to Work

Stopping at a café each morning instead of brewing at home is one of the biggest money drains. Even a modest $4 coffee five days a week adds up to over $1,000 a year. Making coffee at home is far cheaper and still convenient. The habit of daily stops is hard to break but costly over time.

💸 Take Back Control of Your Finances in 2025 💸

Get Instant Access to our free mini course

5 DAYS TO A BETTER BUDGET

Paying for Specialty Drinks

Seasonal lattes and blended drinks often cost nearly double a regular coffee. Many people order them without considering the price difference. A few of these each week can quickly add hundreds to an annual total. The added sugar and calories are another hidden cost to health.

Adding Extras at Checkout

Syrups, oat milk, or extra espresso shots all raise the price of a drink. These small add-ons don’t feel expensive in the moment. But ordering them regularly turns an affordable cup into a pricey routine. Over the course of a year, the extras can add up to the cost of a short vacation.

Ordering Through Delivery Apps

Convenience comes with delivery fees, service charges, and tips. Ordering coffee through apps can nearly double the price of a single drink. Many people rely on this during busy weeks, only to be shocked by their bank statements. Using delivery sparingly saves a surprising amount.

Skipping Loyalty Rewards

Most coffee chains offer free drinks or discounts through loyalty apps. Not signing up means missing out on savings over time. For regular buyers, loyalty programs can add up to dozens of free drinks per year. Ignoring them is like giving away money for nothing.

Buying Bottled Coffee Drinks

Ready-to-drink bottles from grocery stores cost more per ounce than home-brewed coffee. Many people keep them on hand for convenience, but the expense adds up fast. Over time, buying bottled drinks can cost as much as a quality home espresso machine.

Making Multiple Stops a Day

Some people grab coffee in the morning and then again in the afternoon. Even a simple drip coffee twice a day doubles the annual cost. This habit often comes from convenience rather than true need. Cutting back to one trip can cut spending in half.

Ignoring Home Brewing Options

Investing in a decent coffee maker or French press can pay for itself quickly. Yet many stick with café runs out of habit. Brewing at home costs pennies compared to shop prices. Those who skip this option end up overspending year after year.

Not Keeping Track

Many people underestimate how much they spend on coffee each month. Small, daily charges blend into other expenses and feel invisible. Keeping track often reveals hundreds of dollars flowing to cafés and delivery apps. Awareness alone can help cut back without giving up coffee altogether.

Costs Keep Adding Up

Grabbing a coffee for a few bucks doesn’t feel like much, but it adds up when it’s an everyday thing. What looks like pocket change at the counter can turn into a big yearly expense. Cutting back even a little can keep the habit fun without straining your budget.

12 Lifestyle Shifts That Can Save You Thousands Annually

Saving money might feel hard, but small changes add up quickly. Adjusting daily habits can lower costs without giving up what you enjoy. It’s not about going without—it’s about making simple, smart choices that lead to real savings. 12 Lifestyle Shifts That Can Save You Thousands Annually