Some purchases make it clear when someone is struggling with their spending. People notice when you buy things you cannot reasonably afford, even if you think no one sees it. These are the items that often signal overspending and point to financial trouble ahead.

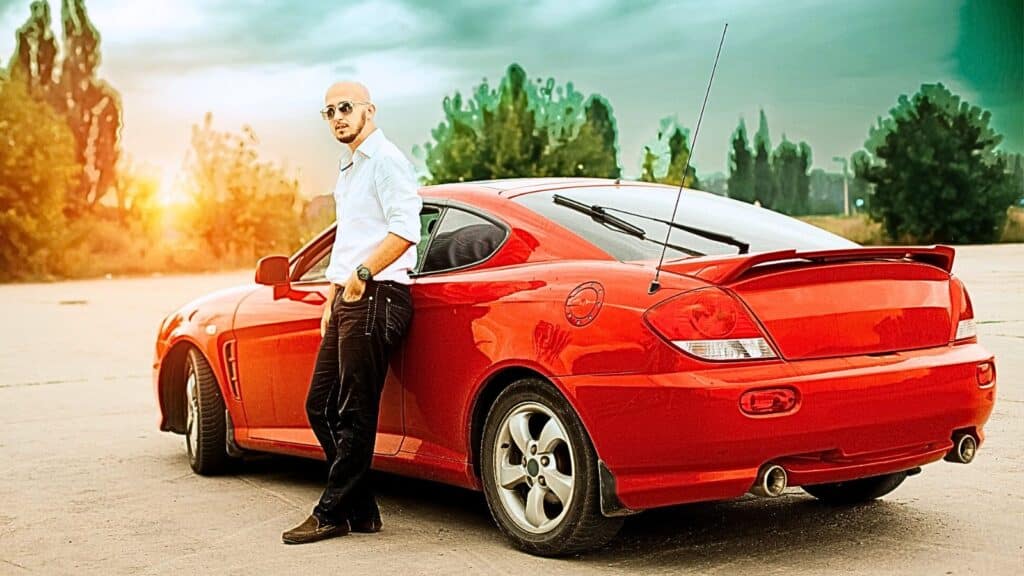

Brand New Luxury Cars

Driving a brand new BMW or Mercedes when you’re early in your career raises eyebrows. A $60,000 car payment of $800 to $1,000 monthly eats up a huge chunk of most salaries. Insurance on luxury vehicles costs far more than standard cars too. People recognize the specific models that signal expensive taste and question the financial wisdom.

💸 Take Back Control of Your Finances in 2025 💸

Get Instant Access to our free mini course

5 DAYS TO A BETTER BUDGET

Leasing new luxury cars every few years shows a pattern of prioritizing appearances over building wealth. Most financial advisors cringe when they see clients driving cars worth half their annual income. The depreciation alone on a new luxury car loses you thousands the moment you drive off the lot. Making better financial decisions means understanding that cars are depreciating assets that shouldn’t dominate your budget.

Designer Handbags and Accessories

Carrying a $3,000 handbag while complaining about being broke doesn’t add up. Designer accessories are visible signals of spending priorities that others definitely notice. The logos and distinctive patterns make these items instantly recognizable. People who work in regular jobs but carry luxury bags raise questions about their financial health.

Authentic designer pieces require serious money that could go toward savings or debt payoff. The secondhand market is flooded with designer items from people who couldn’t actually afford them. Social media has made flaunting luxury accessories even more common and more obviously problematic. Prioritizing a handbag over emergency savings shows concerning financial judgment.

The Latest iPhone Every Year

Upgrading your phone annually when the changes are minimal signals poor spending habits. A new iPhone costs $1,000 or more and your current one works perfectly fine. Phone carriers love people who can’t resist having the newest model regardless of need. The incremental improvements between yearly releases rarely justify the cost.

People who always have the latest tech often carry credit card debt to fund these purchases. Your friends and family notice the constant upgrades and draw conclusions about your priorities. Keeping a phone for three or four years instead of one saves thousands over time. The need to always have the newest thing often indicates deeper issues with impulse control.

Expensive Gym Memberships You Barely Use

Paying $150 monthly for a boutique gym while going twice a month is wasteful. Premium fitness memberships with classes and amenities sound great but rarely get fully utilized. People brag about their expensive gym to justify the cost even when they skip constantly. A basic gym membership costs $30 monthly and provides the same weight loss and fitness results.

The fancy locker rooms and smoothie bars don’t make you healthier if you’re not showing up. Friends notice when you mention your pricey gym but never actually seem to go. Cutting unnecessary expenses starts with being honest about what you actually use. Canceling underused memberships feels bad initially but frees up real money for better purposes.

Frequent Luxury Vacations on Credit

Posting beach photos from expensive resorts multiple times yearly raises questions. International trips and luxury accommodations cost thousands that most people save for carefully. Financing vacations on credit cards means paying interest on memories long after they fade. The constant travel despite claiming money troubles makes others question your financial choices.

People who prioritize Instagram worthy trips over retirement savings often regret it later. Vacation debt takes months or years to pay off while providing only temporary enjoyment. Your social circle definitely notices the disconnect between financial complaints and luxury travel posts. One amazing trip per year beats multiple mediocre ones charged to credit cards.

Designer Clothes for Every Occasion

Wearing head to toe designer outfits regularly signals spending that probably exceeds income. A closet full of expensive brands represents tens of thousands of dollars in depreciating items. People recognize luxury labels and mentally calculate what you must be spending. Fast fashion offers similar styles for a fraction of designer prices but some people refuse to consider it.

The need to always wear recognizable brands often stems from insecurity rather than actual preference. Coworkers notice when someone dresses more expensively than their salary would reasonably allow. Thrift stores and consignment shops offer designer items at huge discounts for people who care about labels. Spending thousands on clothes while carrying debt shows seriously misplaced priorities.

Bottle Service and VIP Club Experiences

Spending $500 on a single night out for bottle service is a red flag. The need to be seen in VIP sections and post about exclusive experiences screams overspending. Regular club goers who always spring for premium experiences often struggle financially behind the scenes. That money could cover a month of groceries or a substantial debt payment.

Friends who suggest cheaper alternatives get dismissed because the image matters more than the cost. The temporary status boost from VIP treatment disappears immediately but the credit card bill remains. People who truly have money to spare don’t usually feel the need to broadcast their club spending. Building wealth requires discipline and choosing long term security over short term status.

High End Restaurant Meals Multiple Times Weekly

Eating at expensive restaurants constantly adds up to thousands monthly. Posting fancy dinner photos regularly while claiming to be on a budget rings hollow. A $100 dinner for two several times per week equals $1,200 monthly on restaurants alone. Cooking at home costs a fraction and allows you to save or invest the difference.

People notice when dining out seems to be your primary hobby despite financial stress. The experience of a nice meal fades quickly but the charges remain on your statement. Friends who are careful with money judge peers who spend recklessly on dining. Occasional splurges at nice restaurants feel special, but constant expensive meals indicate poor financial management.

These purchases aren’t necessarily bad if you can truly afford them without sacrificing financial security. The problem comes when people prioritize visible spending over building wealth and stability. Others definitely notice the disconnect between financial complaints and luxury purchases. Being honest about what you can actually afford leads to better long term outcomes than maintaining expensive appearances.

This article first appeared on Cents + Purpose.