Many money regrets come from choices that felt fine at the time. Over the years, people have realized those purchases didn’t add real value. Some drained savings or created stress that lingered long after the excitement faded. Here are ten common purchases people wish they’d skipped.

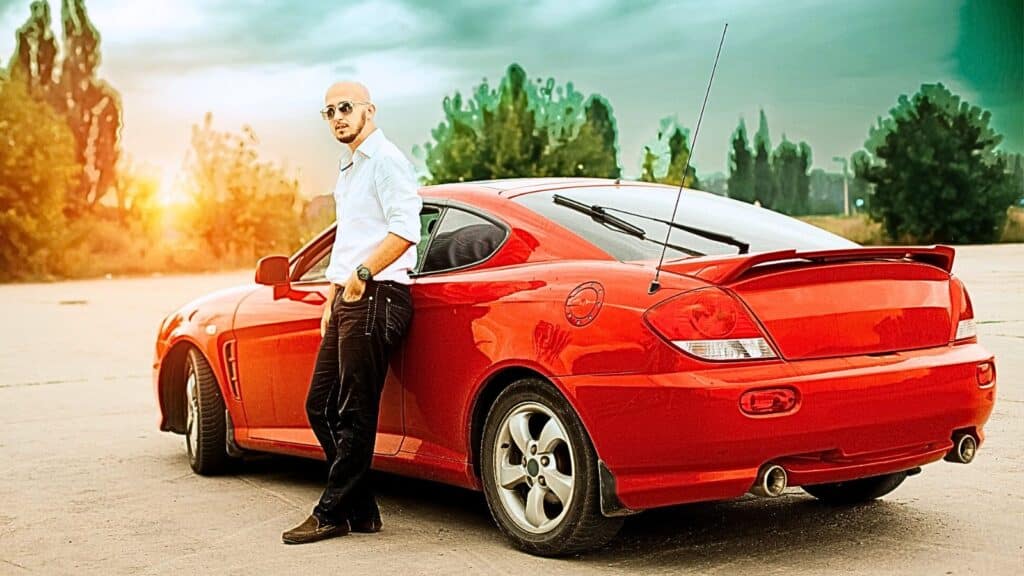

Expensive Cars and Luxury Vehicles

Cars are one of the biggest financial regrets for many people. A brand-new car feels exciting, but the value drops the second it leaves the lot. Luxury cars are even worse, since they come with higher insurance premiums, costly repairs, and expensive parts.

💸 Take Back Control of Your Finances in 2025 💸

Get Instant Access to our free mini course

5 DAYS TO A BETTER BUDGET

Many people admit they stretched their budgets to buy vehicles they couldn’t truly afford. A few years later, the car is worth a fraction of the price they paid, yet the loan or lease payments still sting. People often realize they could have bought a more practical, affordable option and used the extra money for savings or investments.

Home Upgrades That Go Way Over Budget

Home renovations often start with good intentions but can quickly turn into financial headaches. Costs pile up fast, and expensive materials or upgrades rarely pay off at resale. Many homeowners stretch their budgets or take on debt for projects that add more stress than value. The joy of a new kitchen or bathroom fades when the bills linger long after the work is done.

Costly College Degrees With Low Payoff

Education is valuable, but not all degrees lead to careers that justify the price tag. Many people borrowed heavily for majors with limited job prospects, only to find themselves earning salaries too low to cover their debt. Tuition has skyrocketed, and the return on investment isn’t always there.

Those who took on six-figure loans often regret not considering more affordable schools, community college, or alternative training programs. The financial regret lingers for decades, with monthly student loan payments reducing the ability to buy homes, save for retirement, or pursue other goals.

High-End Electronics

Electronics lose value faster than almost anything else you can buy. New phones, TVs, and laptops hit the market every year, making last year’s model feel old overnight. Many people pay premium prices for features they barely use, then watch the next release drop even cheaper. Regret can build when they realize how much money went into tech that didn’t really improve their life.

Designer Fashion and Luxury Goods

Clothes, handbags, and accessories from designer labels often create regret down the line. Luxury fashion is marketed as an investment, but trends shift quickly and resale value rarely matches the original cost. Many people admit they bought items to impress others or feel successful, but the excitement fades once the bills arrive.

Closets fill with expensive pieces that are barely worn, while credit card balances remain. Years later, those purchases feel wasteful compared to what the money could have supported, such as travel, savings, or investments that last longer than a season.

Big Wedding Costs

Weddings are emotional and exciting, which makes it easy to overspend. Couples often spend tens of thousands on venues, catering, photography, and extras. While the memories are meaningful, the debt that follows is not.

Many couples later admit they would cut back on costs if they had the chance to do it over again. Regret comes when they realize the money spent on a single day could have funded a down payment on a home, paid off debt, or built a strong financial foundation for their future.

High-Interest Loans and Buy Now Pay Later Plans

Debt consistently ranks among the top financial regrets. Many people take on high-interest loans or use buy now pay later services without realizing how quickly payments add up. What feels like flexibility in the moment becomes a burden when interest charges balloon the total cost.

A recent survey found that 24 percent of Americans regret overcharging credit cards, making debt one of the most common financial regrets. People often learn the hard way that borrowing at high interest rates does more harm than good.

Premium Gym and Membership Plans

Joining an exclusive gym, country club, or boutique fitness studio feels like a commitment to health, but many memberships go unused. Life gets busy, motivation fades, and the high monthly fees keep draining accounts.

People regret paying for contracts they can’t break or memberships that don’t match their schedules. Even those who attend regularly often realize the same results could have been achieved with more affordable options. Over time, the cost outweighs the value, leading to one of the most common subscription-style regrets.

Investing Without Research

Jumping into investments without proper knowledge is another frequent regret. Some chase trends in crypto, stocks, or real estate based on hype or tips from friends. When values drop, the losses feel devastating. Many realize they didn’t understand the risks or diversify properly.

The regret isn’t just financial, but emotional, since losing money through uninformed choices feels avoidable. Successful investing requires patience and education, and many regret not slowing down to build a strategy before committing large amounts of money.

Overpriced Travel and Luxury Vacations

Travel is one of life’s joys, but overspending on luxury vacations often leads to regret. First-class flights, high-end resorts, and pricey excursions look glamorous but come with bills that linger long after the trip ends.

Many admit they wish they had scaled back and chosen simpler, more meaningful trips that didn’t strain their finances. The regret grows when they realize how much those vacations cost compared to what else the money could have supported. A short week of luxury often leaves behind years of debt or lost savings opportunities.

Financial Regret Sticks

Regret often comes not from spending itself, but from spending that doesn’t provide lasting value. Americans frequently realize they traded security and future goals for temporary satisfaction. By learning from these regrets, people can make smarter financial decisions that support stability and lasting fulfillment instead of short-term excitement.

11 Things People Overspend on Just To Impress Others

We’ve all been there—tempted to spend money on things that make us look good. But sometimes, the urge to show off takes over common sense. Here are 11 common expenses people splurge on just to turn heads (spoiler: they’re rarely worth the cost). 11 Things People Overspend on Just To Impress Others